This is certainly a more palatable and fair approach, which avoids any suggestion of reducing the pledged staking APR, as long as the established APR of 50% remains unchanged.

I see a correct approach. I like

@dc Could you explain to us with some valid argument why Flo’s proposal is simpler and more effective than TNT’s?

In my opinion it is neither simpler nor more effective.

It is not simpler because reducing the rewards proportionally and fairly to what you presented yourself a year ago to the DAO only requires reducing 3 parameters in the reward distribution system already built by Sundaeswap, while reducing everything to a single figure It requires more technical changes, informational effort, angry community, etc. and probably the accumulation of angry community is largely behind the dumping of the LQ reward market.

On the other hand, it is not more effective either because it has never been effective to piss off the community that supports you over and over again and for the following argument:

Whoever stakes for a month or two months does not do so to save the LQ but to sell it at the first good opportunity and, therefore, it does not have a price benefit for the LQ. However, those who stake the LQ with a view to benefiting from rights that are acquired with a timeline have much less incentive to sell when the price begins to rise and, therefore, they are the ones who maintain their price. The conclusion is that long-term holders must be incentivized.

Likewise, think about the fact that those who have been selling all their LQ every week have less strength to acquire LQ compared to those of us who accumulate and repurchase it in addition to our money, with the ADA that we receive. As if that were not enough, think that the largest dump of LQ into the market will have come from the rewards for making deposits and these will be reduced by X4 to which a reduction of 20,000 is added to borrowers. That is, you are going to reduce the offer by more than one X4 in total. Nobody understands why so much radicalism on the part of the team comes from

Another proposal:

Maintain 50% APR for old stakers (do not admit new ones) by meeting several conditions:

- 3-year lock on your LQ.

- Locking your rewards for another 3 years with a different timeline. They could go straight to the vault like Wingriders does with reward WRTs.

This way:

-

The word DAO is fulfilled.

-

Increases the liquidity of the LQ.

-

It does not affect the price of LQ for at least 3 years.

By the time those 3 years have passed, the staking rewards will no longer be available and they will not be able to exert sales pressure via APR. The LQ will be very profitable in ADA, there will be no point in selling by then because you can borrow and pay your loan with the crops

The staking address would have to be linked to the Sundaeswap rewards and the LQs would go to the staking address already automatically blocked in each harvest

The blockade would be voluntary. You can always opt for the 1.25/7.5/12.5% system without unlocking or even the simple 5%.

Everyone happy.

wrt #2, I would like to see some data showing if the sell pressure is coming from stakers’ wallets rather than people selling market participation rewards before I would consider supporting it

Regarding staking rewards, my proposal would be to copy what Cardano does with Ada rewards (which is was already modeled to be similar to BTC):

-

Each week 3% of the remaining LQ allocated for staking rewards is distributed to stakers.

-

These 3% are then split as follows:

-

X - for anyone staking less than 6 months;

-

1.3X - for anyone staking for more than 6 months and less than 12 months;

-

1.5X - for anyone staking for more than 12 months.

-

Rewards would gradually decrease over time like it happens with Ada rewards and would last for decades and we would still reward long term stakers. We don’t need to reinvent the wheel.

@TNT1 @AliD @ConkeyKong @JakeMN @ItsDavidd

Thank you all for participating in the discussion and seeking to understand the big picture.

Currently, the discussion about staking is focusing on the tree rather than the forest. I will here below explain my view and how everything is connected.

(This post serves as a response to the post on Liqwid-POL and post on LQ buy back.)

As it was mentioned, to establish a Protocol-Owned Liquidity (POL), we need to address several key points:

- Reduce LQ inflation.

- Stabilize the LQ price.

- Accept LQ as collateral.

- Finance the ADA part with LQ as collateral.

Having a substantial POL position would enable Liqwid to:

- Generate revenues from the POL (and gradually repay the loan).

- Stabilize the LQ price.

Additionally, we could consider distributing protocol revenues in ADA and/or LQ (and performing LQ buy-back as it was proposed to support the LQ price).

Indeed, all these proposals could be implemented, but it all begins with reducing the current LQ inflation.

It’s also important to note that financing for Liqwid has been expended since 2021. The Core team has efficiently managed operations, raising only $2.7M while consistently delivering new features, showcasing top-notch Cardano expertise and operational proficiency. They have exceeded expectations with the v2 protocol and new infrastructure developments, which may not be visible to users immediately but will have significant long-term benefits. However, preparing for new financing requires a stable LQ price to secure favorable terms.

I anticipate that approximately at least 10-15% of the LQ supply will be necessary to finance Liqwid for the next 2-3 years. This aspect hasn’t been addressed or discussed in the Discord Channel because everyone is primarily focusing on their individual benefits rather than considering the future of Liqwid, which is the responsibility of the Core Team.

Attached are different protocol’s tokenomics for reference about what is “normal” to expect. It’s unrealistic to think the creation of a billion-dollar protocol costs only around $2.7M (total raised) and ~18% LQ supply given to the team, who have kept most of their tokens (and received NO staking rewards and NO Programmatic distribution and having 2 year vesting while working since 2021). Many may not fully appreciate Liqwid’s efficiency and cost-saving measures in operations, but there are limitations to consider.

The reality is that a high LQ token issuance does not provide any value for the Liqwid protocol in the long term; instead, it jeopardizes its chances of success.

I don’t understand the tokenomics you propose. Where would that 10-15% of LQ that would be needed to finance the development of Liqwid come from?

By the nature of your response it seems that you are in favour of the LQ buy back system.

Therefore, to further increase the value of the LQ token you should;

- Make LQ a utilisation token (by holding X number of LQ suppliers can benefit from receiving a higher % of the interest generated by their assets, see my other proposal about this)

- Introduce buy backs asap

- Choke the emissions slowly.

- Increase the 2nd interest rate slope asap! this will increase the interest the protocol generates giving it more income! the current 2nd slope is ineffective and has failed to reduce the utilisation % for over-utilised assets.

Also let us know how we can assist in raising capital, current Liqwid protocol participants may want to assist in this process.

Would 10-15% of LQ come from Liqwid treasury?

Couldn’t the commissions generated in Liqwid and pool farming in Minswap finance the development? It is a topic that has never been talked about. The official information was that Liqwid is a very well-funded project, implying that there were no additional financing needs.We need transparency to be able to think and support the best decisions for Liqwid

Hi @FlorianVolery and Community.

I back the intent of this post entirely and believe that this reduction of emissions is currently needed to support price and protocol stability, increase the safety pool and to explore the POL further to generate more revenue. With the analysis provided in this Temp Check and along with the details shared in the Liqwid Protocol - Data analytics over the past 12 months

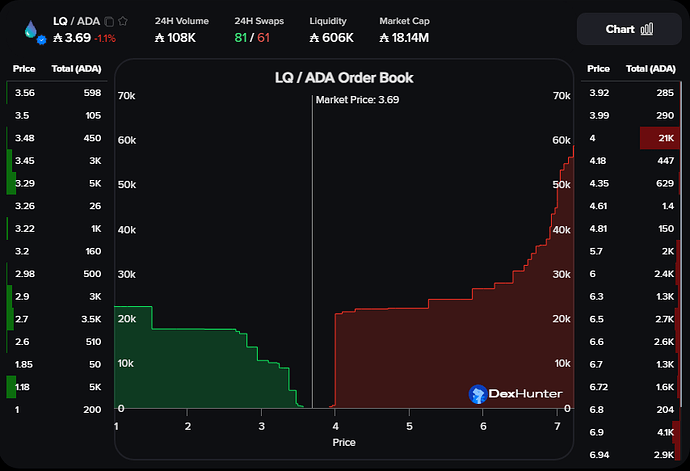

As laid out in my analysis in the 12-month post, we historically have been looking at 60k-100k worth of LQ sell pressure a month. Most price swings occur due to ~1-5k ADA worth of sell-offs that are recouped by smaller bu s., which is evident from the constant sell wall of 22k vs the total buying orders of roughly 23k ADA

this sell wall has been there for months. Reducing emissions will reduce this wall and bring more orders into the 2% depth of the order book, stabilizing the price.

In Point 1

reducing the total emissions by 95K will be significant enough to stabilize the selling pressure in the market. While also preserving LQ for future adjustments up or down.

in Point 2

The original proposal to increase the APR to 50/30/5 did not directly indicate when this would reach a sufficient level of dispersed LQ to stakers or did it explore until the past month when the 2.1 million LQ would deplete for stakers. This is an error for the greater community and learning lesson in governance because we did not maintain an analysis of this proposal sooner. Significant community analysis has revealed that this stake pool will not run out at the end of 2024. However, it will run out mid- to end-of-2025 by all analysis accounts, which makes the additional six months trivial.

The LQ staking pool is not the main source of sell pressure( 100k + 20k User Dist. Stakers present day 40k a month). However, this dispenses more and more LQ each month and is projected to payout 100K+ by September 2024, negating Point 1 reduction. This means the stake pool must be reduced before September for all three points to have a positive outcome. A return to a flat 5% + aquafarmer is too extreme, and a balance can be found. Many great proposals have been shared in this forum and temp check, with insight on working toward a better balance of LQ emissions. We need to see only a 60-100k emission reduction. Point 1 achieves this. A stake pool incentive higher than 5% will also allow LQ holders to achieve a higher return and still reduce emissions. To find the balance, we must define and measure the long-term strategy for the stake pool. How long do we want it to last, how fast should we go through it before slowing it down, and so forth? All three of these points are foundational. Point 1 is the cornerstone we need to build more upon. The 50% APR should be removed immediately; this will reduce the payouts/emissions and preserve the LQ pool while it can be assessed in real-time(versus in a vacuum of spreadsheets) if Point 1 is sufficient enough along to reduce LQ emissions to achieve stability. As proposed by Florian, the next three months should be enough time to work through the outcome of Point 1 and see if the stake APR needs further reduction. If it has not, then a return to a flat 5% should occur. Removal of the 50% will also keep the initial playing field level as its only been active for a few weeks. This will allow community sentiment to stay positive. For anyone who truly calculated their own analysis for 50% rewards ( on their own ROI for staking) would have realized that it was not sustainable and would need to be adjusted. The amount of LQ we want the stake pool to emit in the next three months should be decided upon after Point 1 goes into effect and a minimum of two months for analysis. Why, currently, of all emissions the stake pool is the smallest. Placing a cap on how much can be emitted per month could also be an option to explore and help overall protocol health during that three-month moratorium.

Point 3

is a nice addition to elevating some contention from point 1. This will be a long play as the current value in the present day is not significant but has the potential to be significant with Liquids year-over-year growth.

Would you be more willing to support Point 2 with a reduction in Staking APR after a 2 months analysis of the affects of Point 1?

- Yes

- No- never

- No- because I already support Point 2 as is.

- No- Point 2 still needs more revision to support Staking APR reduction

Congratulations. In general I liked your proposal. I voted NO and that it needs more analysis because I think the proposal needs to be more complex. When a company promises share issues of 5%/30%/50% depending on the age of staking 0/6/12 months, it is: 1) Approving a number of issues and 2) Differentiating percentages by age in the staking. All the proposals published since Flo’s original seem to only take point 1 into account and focus on reducing emissions, forgetting that there is also a point 2. If it is necessary to reduce LQ emissions, simply reduce or limit the amount of monthly LQ emissions as staking, which does not mean, at all, any need to modify point 2 or proportional thresholds. You claim that 40,000 LQ of staking are being issued per month. Let’s say that we observe two months after the drastic reduction of deposit rewards that is not enough for the increase in the market price of the LQ token… then we can approve that the staking figure be limited, for example to 30,000 LQ per month, or 20,000 LQ per month, but maintaining the percentage level of the original proposal. That is, for 0/6/12 month staking increases staking boost of x1/x6/x10 within the reduction. This would comply with the reduction of emissions in terms of staking but respecting as much as possible what was approved by the DAO.

If this point 2 that I write is taken into consideration, the proposal would have my support

The proposal is to reduce staking issuances to a fixed amount (for example 25,000 per month) leaving the current boost increases of x1/x6/x10 for staking aged 0/6/12 months unchanged. It is a hybrid proposal that takes into account the health of Liqwid and also the credibility

If the same x1/x6/x10 increase is applied to ADA rewards, a double effect would occur: 1) Encourage long-term staking (which is what has saved the price of LQ until now) and 2) Compensate in part to the community for the drastic reduction of the 50% APR approved in the DAO at the initiative of Liqwid’s own core team

What I propose to apply point 1 and 3 of Flo’s proposal with the imminent launch of V2 and apply point 2 with the specifications described on the date proposed by Flo and with a maximum amount of staking emissions approved after 2 months of analysis LQ price after V2 launch

@FlorianVolery @DC1

I think most users agree with the premise of the need for a change. I don’t disagree with the reasoning and the benefits of what is proposed, I disagree with the approach being taken. Like many, a commitment was made by Liqwid bootstrap governance and generate an active community by offering stake rewards in exchange for a commitment of staking. I see the long term benefits of changing this, but I think Liqwid should find a way to honor this commitment in the short term which I what led me to propose an example of decreasing LQ rewards as protocol distributions increase. This avoids the “cliff” of this proposed hard change and still rewards early stakers. I would even further suggest that it only apply to people that will reach 6 or 12 months by April 1st, 2024 (or some other near-term date and they are grandfathered in) and any new stakes would be subject to the new proposal. I admit this probably causes additional effort on the team to calculate different reward schemes.

We are all eager for a solution that establishes security and predictability to the investment as well as the launch of V2

I believe you area onto the formula for consensus.

This is a great start and would help the analysis of the LQ emissions be studied more. We Could use the 3-month cliff proposed by @FlorianVolery as the window( reduce to 5% by July 1st). This means turning off the User Distribution ASAP. It is worth noting that there are **three ** different LQ Staking emission models(by Johnny Sachs, @nufnuf , and @ConkeyKong ) that all project that by September-November(depending on model), LQ stake emissions will be 100k larger than the present day, or roughly 140k a month. Zooming out from the present day, we can see that this conversation is inevitable to avoid and would be best to solve today versus putting it off another 3-6 months. Meaning that in a few months Staking emissions will be greater than the User Distribution reductions. This is where the CAP systems or max amount per month with time-weighted distributions described by @Khelben. @TNT1 @JakeMN all have considerable merit to explore more. Or the proposal from @itzDanny( with a high favor of yes votes) with a max cap of monthly emissions.

Ultimately, if we as a community believe that Point 1 reduction(80%+ in favor) will help with the goal of stability in price, protocol, community, and safety model, then we should take a similar approach to the Staking rewards emitted and that should lead us to a conclusion that a reduction of some magnitude must occur sooner rather than later.

-

Reduce deposit rewards immediately to 25% of the current one (nullifying rewards to ADA borrowers)

-

Analyze the price of LQ with these changes + everything that the launch of V2 entails and within 3 months make a decision to maintain or quantitatively limit the maximum staking LQ released per month keeping intact the x1/x6/x10 boost relative to age x1/x6/x12 months

-

Introduction of x1/x6/x10 boost to ADA rewards along with the reduction, if applicable, of the maximum staking rewards released per month

-

Promote Aquafarmers NFTs

-

Better measure proposals for the future

Launch V2

Edit of the original proposal (16.04.2024):

After careful consideration, it’s evident that the 10x/6x/1x ratio is overly large and could deter new participants, despite it being the primary incentive to purchase LQ tokens for passive income. Therefore, it is modified to 5x/3x/1x.

Additionally, an end date of December 31, 2024, has been introduced for this feature. The DAO can subsequently vote on whether to implement a new mechanism, but the “early joiners” staking boost cannot be sustained indefinitely.

New proposal text about the staking boost:

From July 1st, 2024, to December 31, 2024, all stakes that are older than 6 months but less than 1 year will qualify for a 3x boost. Additionally, all stakes older than 1 year will qualify for a 5x boost on the total amount of LQ stakes considered for the allocation of programmatic distribution during this period. Stakes below a 6 month duration will have no additional boost.

All programmatic rewards will be distributed on a monthly basis. As of December 5, 2023, this distribution is exclusively in ADA, as determined by a vote.

Commencing January 1, 2025, all wallets staking LQ will be treated equally, without discrimination. Each wallet will receive a standard 1x reward, and the eligibility for boosts will cease. This date marks the discontinuation of various reward programs designed to incentivize early investors in Liqwid. It is worth noting that any additional programs can be subject to future votes.