Summary

This is a proposal for adding the 1month and 3month Optim Bond Tokens as isolated collateral types in the Liqwid v1 ADA market.

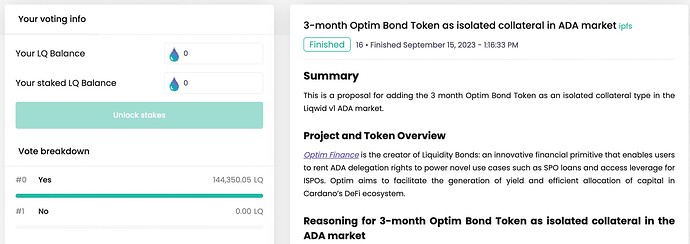

The onchain vote for the initial parameters to support the 3month Bond Token passed with unanimous support: Liqwid App

Project and Token Overview

https://app.optim.finance/dashboard

Optim Finance is the creator of Liquidity Bonds: an innovative financial primitive that enables users to rent ADA delegation rights to power novel use cases such as SPO loans and access leverage for ISPOs. Optim aims to facilitate the generation of yield and efficient allocation of capital in Cardano’s DeFi ecosystem.

Reasoning for 1-month and 3-month Optim Bond Tokens as isolated collateral in the ADA market

The 1-month Bond Token is now the shortest duration bond offered and lowers the duration risk for liquidators who may be need to hold the bonds to maturity.

1 month Bond Token backed loans allow ADA lenders to generate consistent revenue in 6 epoch increments with 0 price risk for the collateral.

Bond Tokens (BT) are tokens denominating a user’s fractional position of a bond loan. As Cardano Native Tokens, they can be used to interact with the wider DeFi ecosystem, such as marketplaces and lending protocols. At maturity Bond Tokens can be exchanged for the underlying ADA plus all accrued interest. Every Optim Bond Token is equal to 100 ADA plus the interest the bond issuer provides on the bond (active bonds can be closed if the SPO/bond issuer fails to meet the terms of the bond by not providing enough interest to stay above the 1 month [6 epochs] Interest Buffer minimum threshold). Active bonds with interest above the 1 month Interest Buffer can only be closed once they reach maturity.

As Bond Tokens are always redeemed at par value of 100 ADA (plus interest) they can be priced at the current market price of ADA * 100 (100 ADA = 1 BT). The 100% price correlation of Bond Tokens and ADA removes all price risk from the protocol when BT’s are used as isolated collateral in the ADA market. This greatly reduces the probability of liquidations for Bond Token backed ADA loans and is a low risk method to increase utilization in the ADA market.

This is a win for Liqwid ADA suppliers as increased utilization directly translates to increased ADA Supply APY and total yields as ADA borrows backed by 3 month Bond Tokens are repaid with interest to redeem the BT’s in Optim once they reach maturity.

Risk Considerations

By supporting 1month and 3month Bond Tokens as isolated collaterals for the ADA market the price risk is fully removed (1 BT = 100 ADA). Isolated collaterals for correlated assets reduces the risk of price movements (e.g. a decrease in collateral asset value or increase in borrowed asset value) triggering liquidation events. This protects the Liqwid protocol and its users, specifically ADA market suppliers.

The remaining risks are interest rate risk and duration risk. The duration risk is mitigated to the largest extent possible by only enabling the shorter end length BT’s supported on Optim. The interest rate risk means if the accrued interest on an ADA loan grows too much the borrower may go above their max borrow amount and risk a liquidation event.

By only enabling Bond Tokens as collateral for ADA loans the protocol ensures no Bond Tokens can be borrowed as users will lock Bond Tokens directly to the borrow script when they create a new ADA loan. This also guarantees Bond Token holders will receive back the exact same Bond Tokens they lock as collateral once they repay the loan.

Optim Bond Tokens will only be enabled for use as collateral locked directly in an ADA borrow script. This means Bond Tokens will not be allowed to be borrowed from the protocol and ensured Bond Token holders will receive the exact token name Bond Token they lock as collateral when creating the loan.

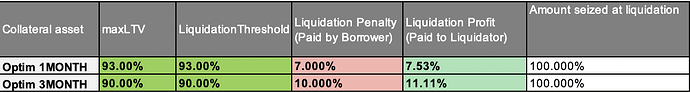

UPDATED PARAMETERS

NOTE: If the Bond Token includes an APY paid by the Bond issuer the effective liquidation profit is more than 11.11% for the 3month or 7.53% for 1month as the liquidator receiving the Bond Token can redeem it at maturity in Optim for the 100 ADA face value plus the full amount of interest provided on the bond by the Bond Issuer. This can be completed directly in the Optim app. As price risk is fully removed liquidators always earn a 11.11% or 7.53% liquidation profit, regardless of when they actually redeem the bond token in the Optim app. At maturity the liquidator will always receive an effective liquidation profit of interest provided on the BT by the Bond Issuer + 11.11% for the 3month or 7.53% for 1month.

Specifications

The core team has completed the configuration for the oracle price feed, implemented the frontend updates for the collateral distribution sections of borrow/repay/modify collateral modals and has tested the liquidation for Bond Tokens on Preview.

Conclusion

The core team recommends the adoption of this proposal and to add support for the 1 and 3-month Optim Bond Tokens as an isolated collaterals in the ADA market. This proposal only supports Bond Tokens for use as collateral in the ADA market.

Do you support this proposal updated parameters to add 1 and 3-month Optim Bond Tokens as isolated collaterals in the ADA market?

- Yes

- No