Summary

This proposal aims to offboard the SHEN token as collateral within the Liqwid protocol with the exception of the ADA market.

Following a successful vote, users will have only the option to use SHEN as collateral to borrow ADA while opening new loans.

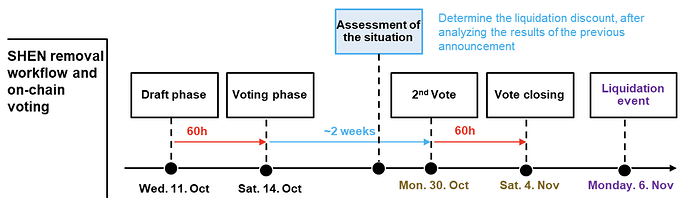

Existing loans backed by SHEN as a collateral for borrowing any debt other than ADA will have their SHEN collateral be liquidated on November 6, 2023, following the completion of this 2 stage process.

The SHEN liquidation discount may be increased temporarily before this liquidation event, if on November 4, 2023, a governance vote is passed.

Reasoning for offboarding SHEN collateral from all markets except ADA

The SHEN token currently has a total supply of 31 million ADA, valued at approximately $7.75 million. (data: Taptools) Some are part of the ADA/SHEN pool on Minswap, which is worth around 1.9 million ADA (approximately $~500k). This consists of approximately 1 million ADA and 1 million worth of SHEN, translating to $250k ADA and $250k SHEN on Minswap. Notably, Wingriders holds the largest ADA/SHEN pool with $890k, equivalent to approximately $445k worth of SHEN. In total, there is slightly less than $700k worth of SHEN in liquidity on Cardano.

Data from Minswap and Wingriders*

The total assets available in the pools are considerably low when compared to the total circulating supply of SHEN (~10%). Consequently, a large sell order for SHEN would result in a significant price drop on any decentralized exchange (DEX).

Furthermore, SHEN cannot currently be redeemed in the DJED protocol because the current reserves (293%) are below the required 400%. Even if this option was to be activated, the high fees would deter SHEN holders from doing so, making this arbitrage mechanism inefficient.

Lastly, the lack of demand and use cases is why SHEN has not been widely used as collateral or for borrowing. The total supply of DJED is currently capped at 4.1 million due to the reserve mechanism design, which requires a ratio above 400% for new DJED minting, with the current ratio at 293%.

Finally, as the price of SHEN is linked per design to the value of ADA, we observed that its price has been correlated with the ADA price since its launch. Therefore, we are recommending to use SHEN as collateral only to borrow ADA.

Wind-down Phase for SHEN as collateral:

*To be implemented after a successful vote on October 14, 2023.

-

Modify the front-end to prevent users from:

Adding more SHEN as collateral in non-ADA loans

Increasing the debt of existing SHEN-backed loans, where the debt is not denominated in ADA.

Opening new SHEN-backed loans, where the debt is not denominated in ADA. -

Users with existing SHEN-backed loans will still be able to repay their loans, withdraw SHEN collateral, or add new collateral (ADA, DJED). Loans with multi-collaterals (incl. SHEN) will be able to function normally for the non-SHEN part.

-

Develop and communicate clear information to users about the status of SHEN following the on-chain on Discord and Twitter, including the effective timeline for a full reduction of their collateral factor following a successful vote.

-

On Monday, October 30, 2023, the Liqwid Team will propose a vote to determine if the liquidation discount should be increased, based on the remaining volume of SHEN being used as collateral to borrow assets other than ADA.

-

Following a vote on the liquidation discount, the collateral value of the SHEN will be set to zero on Monday, November 6, removing completely the collateral from the protocol, except where it is used to borrow ADA. (This event is called the “Liquidation date”).

Conclusion:

The Core Team recommends adopting this proposal to remove the SHEN token from being used as collateral in Liqwid, except for borrowing ADA. It should be noted that SHEN can still be supplied and borrowed after a successful vote.

Do you support this proposal to offboard SHEN as collateral in all markets except for ADA?

- Yes

- No