Summary:

This proposal aims to update the LQ markets risk parameters to bring them in line with the current settings of other top CNTs such as MIN.

Reasoning:

LQ is the reserve asset of the Liqwid protocol. As such LQ holders should be allowed maximum capital efficiency of the token compared to that of other top CNT markets on Liqwid.

Risk Considerations:

The technical risks of a market parameter update is mitigated by comprehensive testing of the LQ market risk parameter changes on preview testnet.

Proposal Specification:

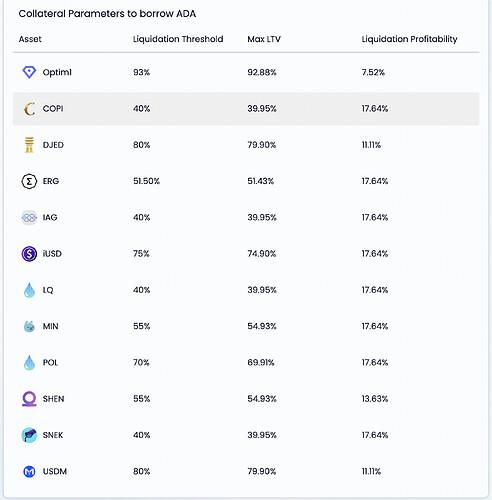

If passed the LQ market risk parameters would undergo the following changes:

- maxLTV should increased from 39.95% to 54.93%

- liquidationLTV increased from 40% to 55%.

Conclusion:

Liqwid Labs core team recommends the adoption of this proposal to update the LQ market risk parameters to allow LQ holders capital efficiency equal to other top CNT markets on Liqwid.

Do you support this proposal to update the LQ market’s risk parameters?

- Yes, I do support this proposal to update the LQ market risk parameters

- No, I do not support this proposal to update the LQ market risk parameters