UPDATE: This temp check is being paused to first observe the potential effect (if the proposal is voted in) of the updates to temp check http://govnew.liqwid.finance/t/update-to-supplier-borrower-lq-distribution-rate/976) which will 1. set the supplier-borrower reward split to 100-0 (from the current 50-50 split) and 2. will eliminate rewards for suppliers who complete wash borrows in an attempt to increase their supply position (e.g. 1. User supplies 10k ADA → mints 10k ADA worth of qADA, 2. User locks 10k ADA worth of qADA as collateral → borrows 7k ADA ==> The Liqwid rewards system will spot this wash borrowing and remove LQ rewards to the initial 10k ADA supplied). It does not matter what the user does with the 7k ADA later because they’ll have already forfeited LQ rewards on their initial 10k ADA supplied.

Want to give a huge thanks to @LapinMalin for discussing the approach outlined above. We feel confident this provides a fair, and balanced rewards model while efficiently disincentivizing wash borrowing.

Following community feedback on the last temperature check to update the supplier-borrower rewards ratio in both the ADA and DJED markets from 50-50 to 100-0 to reduce the level of recursive borrowing observed on the protocol (http://govnew.liqwid.finance/t/update-to-supplier-borrower-lq-distribution-rate/976) the core team has met and discussed a more thorough approach to removing recursive borrowing as we get set to launch LQ rewards distributions for months of February and March.

As community member @LapinMalin correctly points out, updating the rewards distribution ratio is only a partial fix to the issue as yield farming focused users will still attempt to maximize their supply side via recursive borrowing transactions.

As a result the core team proposes the following change to the ADA & DJED market collateral parameters:

- disable qADA as collateral in the ADA market and disable qDJED as collateral in the DJED market.

1. Update: instead of disabling qADA as collateral in the ADA market (requires an on-chain update), we can instead apply a 0 reward “penalty” to users borrowing ADA with qADA collateral (same for users borrowing DJED with qDJED collateral).

UPDATE (Amendment to the initial temp check): the core team has discussed this collateral parameter change and feels a simpler path forward (requires no on-chain changes to the protocol) but achieves the same intended goal to remove incentives for wash borrowing by removing all rewards for users with recursive leverage. Using the rewards distribution system we’ve built we can easily query and filter out all loans which are using the qToken for that underlying asset (e.g. any user borrowing ADA backed by qADA would receive 0 LQ rewards).

By removing the ability to earn any LQ rewards from recursive borrows this will reduce incentives for recursive borrowing activity in the protocol. This will result in more organic borrow activity and alongside the last temperature check to update the supplier-borrower rewards distribution to 100-0 (currently 50-50) should provide a more healthy future for the launch of LQ user distribution rewards in light of the yield farming focused strategies that pose risks to the protocols.

If successfully voted in the SHEN market which has passed its new market vote and is set to launch on mainnet early this week (and all future markets) will be deployed on mainnet with this collateral parameter update that disables the ability to borrow underlying assets against the qToken collateral of the same asset.

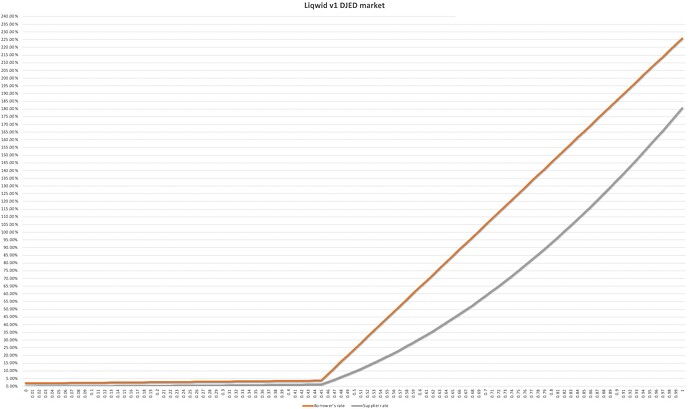

The second update the core team has proposes to the interest rate model with the same goal of removing yield farming driven recursive borrowing activity is to reduce the kink point for both the ADA and DJED markets from 75% market utilization to 45%.

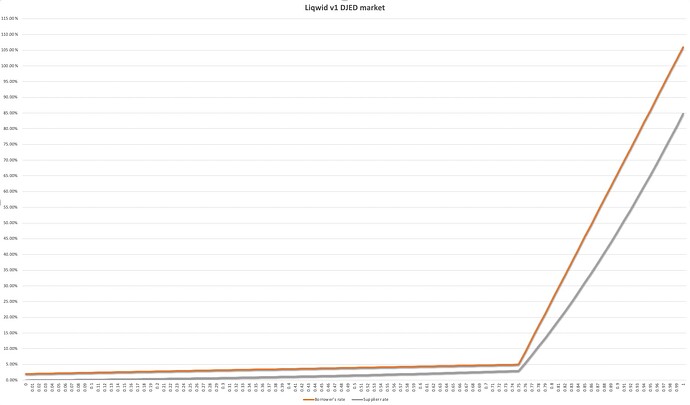

As a refresher the Liqwid v1 interest rate algorithm operates the same as AAVE/Compound, each market has two slopes, the first being a slow and gradual increase in rates for suppliers and borrowers starting at 0% market utilization (0 assets borrowed) and the second slope, which goes into affect at a governance defined market utilization called the “kink point” increases the supply and borrow rates at a significantly steeper acceleration rate. By reducing the kink point level the interest rate algorithm will move to the second slope (higher borrow and supply rates) at an earlier market utilization incentivizing borrowers to repay their loans and new suppliers to deposit assets to earn the increased supply APY. Yield farming driven strategies that result in recursive borrowing will be forced to pay a significantly higher borrow APY, which will ultimately work to disincentivize these strategies entirely.

The interest rate curve below highlights the current kink point for the DJED market, implemented at 75% (ADA market also has a 75% kink point)

Following the updated kink point reduction from 75% to 45% the interest rate curve for the DJED market will be updated to the following:

Do you support the updates to the collateral and interest rate parameters for ADA, DJED and future Liqwid v1 markets with the intended goal of reducing recursive borrowing?

- Yes

- No