This is a proposal for creating a new liquidity pool to support AGIX token for lending and borrowing and as isolated collateral in the ADA market on Liqwid.

Project and Token Overview

AGIX is a Cardano native token focusing about artificial intelligence. (More information in https://singularitynet.io/).

SingularityNET is an AI marketplace designed to allow anyone to “build, share, and monetise” Artificial Intelligence services. It is designed to connect and repurpose existing AI tools to suit the purchasers’ needs. These tools can be shared, bought and sold on SingularityNET’s decentralised marketplace.

According to the team: “Off-the-shelf AI generally isn’t fit for purpose, and only tech giants can hire teams of engineers to customise the software. SingularityNET is building an automated process that allows any business to connect existing AI tools to build the solution it needs.”

After ADA token, the AGIX is the most Cardano native traded tokens across all CEX and DEX platform.

The token price has seen a really big increase of volume and valuation over the 90 days, which led to a total average volume of $47M, with 2 all-time-high trading days of $123M and $ 86M on July 14-15 2023.(see https://www.coingecko.com/en/coins/singularitynet/historical_data)

AGIX Market Reasoning

The AGIX token is listed on many CEXs and Cardano DEXs with several market makers performing the arbitrages between these platforms. This means that if the AGIX tokens would be sold on a DEX, as part of a liquidation process following a defaulting loan where AGIX is the collateral, we are confident that liquidators would find enough liquidity and that the slippage would be low because of these arbitrageurs.

Therefore, we propose to add the AGIX token as eligible collateral on Liqwid.

Suggested AGIX Market Parameters

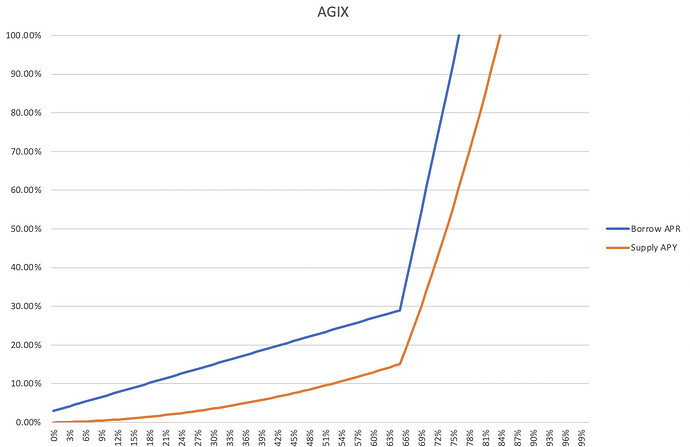

The proposed AGIX interest rate parameters are set to the same as the ADA market starting with a base rate of 3%. AGIX supply cap will be set to $6M. AGIX borrow cap will be set to 50% of the total AGIX supplied.

Interest rate market parameters:

- RateBase: 3.00%

- RateNormal: 40.00%

- RateJump: 600.00%

- Kink: 65.00%

Income Factor: 80% of the interests paid by the borrowers are payed out to the suppliers (same as the ADA and stablecoin markets). The remaining 20% is split as following:

- Reserve Factor: 0%

- DAO Factor: 10.00%

- LQ stakers: 10.00%

Proposed AGIX Risk Parameters:

- Collateral factor (maxLTV): 63%

- Liquidation threshold: 65%

- Liquidation penalty: 17%

*AGIX will be supported as an isolated collateral in the ADA market.

Risk Considerations

Despite being one of the oldest Cardano tokens (launched on January 2018), the project has not yet fully deployed its smart contract platform for artificial intelligence purposes.

The project has many promises (Ecosystem - SingularityNET - Next Generation of Decentralized AI) but is still in its infancy, which led to a conservative approach regarding its maximum authorized collateral factor.

Specifications

Following this temperature check, the team will work on AGIX preparation work including: 1) configuring the AGIX oracle price feed.

Conclusion

The Core Team recommends the adoption of this proposal and to add AGIX as a token for lending and borrowing on Liqwid with the proposed market and risk parameters.

Do you support this proposal and to add AGIX as a token for lending and borrowing on Liqwid with the proposed market and risk parameters?

- Yes

- No