Summary

This proposal aims to update the supply caps for Cardano native token markets within the Liqwid protocol.

Following a successful vote Cardano native token markets will have supply caps updated to 20% of onchain USD side only liquidity (ADA, stablecoins). If 20% or more of the onchain USD side only liquidity is already deposited the supply cap will be set to the market’s current supply level. The exact number of tokens for each market’s supply cap will be determined based on the USD side liquidity and price of the asset at the time of update using the 20% method.

Reasoning

Liqwid liquidators require timely access to USD side liquidity with as minimal slippage as possible to capture their liquidation bonus when repaying unhealthy loans. Liquidations are a critical action that protects the protocol from unhealthy collateral to debt levels. The onchain liquidity levels fluctuate continuously and thus the supply cap settings need to be continuously monitored and periodically updated to mitigate this risk.

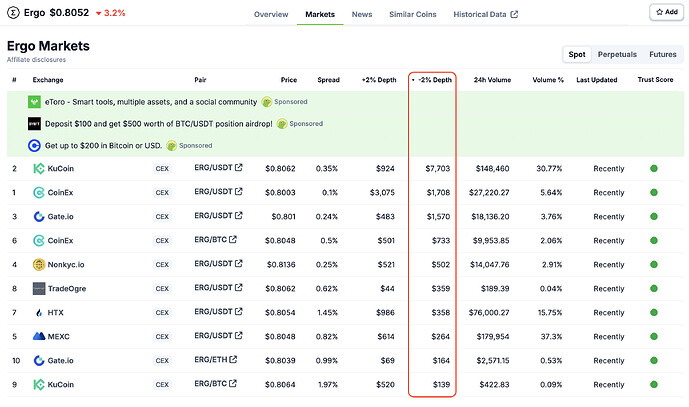

Relying on centralized exchanges for liquidity presents multiple risks: the CEX could experience downtime or even pause withdrawals during periods of high volatility (this occurs even with tier 1 exchanges such as Coinbase and Binance) and the shallow depth of CEX orderbooks for most CNTs places substantial risk on the Liqwid protocol and its liquidators.

The initial supply cap settings accounted for CEX orderbook volumes that may be inaccessible during high volatility periods where immediate action is required by liquidators for the protocol outstanding debt to remain at healthy levels. As such this liquidity should not be relied upon as a readily available source of USD liquidity the way onchain liquidity is. In addition to liquidators requiring timely access to USD liquidity for a CNT which can only be fully guaranteed onchain, the -2% depths of the CEX orderbooks would not be able to sustain large orders and liquidators would still experience large slippage amounts. This places significant risk on the Liqwid protocol that should be properly mitigated through periodic adjustments to CNT market supply caps.

Conclusion

The Core Team recommends adopting this proposal to reduce Cardano native token market’s supply caps on the Liqwid protocol according to the 20% method.

Do you support this reduction of the supply caps for Cardano native token markets with the proposed parameters?

- Yes

- No