Proposal Overview

This proposal seeks to implement 4 updates to all Liqwid stablecoin markets which currently all share equal interest rate parameters:

- Increase the kinkPoint from 65 to 90%.

- Increase the utilMultiplier from 4% to 33%.

- Increase the utilmultiplierJump from 775% to 100,000%

- Disable borrow caps on all stablecoin markets.

Markets Update Reasoning

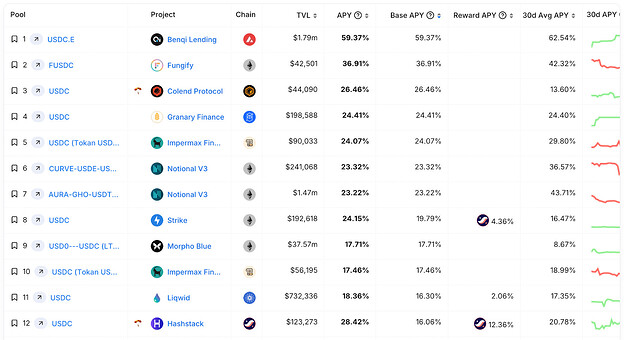

Liqwid stablecoins are the most utilized markets in the protocol. Cardano DeFi market participants have expressed strong preference for USDC denominated debt as evidenced by Liqwid USDC market having the 6th highest yield for USDC-only liquidity pools across all lending protocols on every chain tracked by DeFillama: https://defillama.com/yields?token=USDC&category=Lending

-

Increasing the kinkPoint to 90% enables the maximum amount of stablecoins on Liqwid to be borrowed at the lowest possible interest rates. Optimizing for capital efficient borrowing allows the protocol to generate maximum revenue as more capital can be actively borrowed without a steep increase in interest rates that occurs in slope 2 post-kinkPoint.

-

Increasing the utilMultiplier ensures Liqwid stablecoin suppliers continue earning the most competitive yield possible which the market has established as Liqwid’s organic stablecoin borrow rates due to sustained market utilizations in all stablecoin markets in the 60-70% range.

-

Increasing the post kinkPoint slope’s steepness encourages borrowers to repay loans and for additional stablecoin liquidity to flow into these pools to earn maximum yield.

-

Disabling the borrow caps will allow stablecoin markets to be fully utilized up to 100%. Suppliers who deposit in these markets will be compensated by an increase in the slope 2 steepness compared to current level and the highest yields possible (currently Supply APY at 100% utilization is 106.6% APY, new Supply APY at 100% utilization is 142.9% APY).

Current and newly proposed stablecoin interest rate models:

Risk Considerations

A risk to consider with this update is liquidity risk to stablecoin lenders as utilization in these markets grows. The compensation for the liquidity risk stablecoin lenders face as utilization grows close to 100% is the increased yield from a steep interest rate hike that goes into effect at the kinkPoint.

Specifications

Liqwid Labs developers have completed the necessary testing and technical requirements needed to implement the proposed interest rate parameter updates to the stablecoin markets.

Conclusion

Liqwid Core Team supports these interest rate parameter updates to the stablecoin markets to maximize borrowing capacity and capital efficiency.

Do you support this proposal?

- Yes, I support this proposal.

- No, I do not support this proposal.