Summary

The following stablecoin market parameter updates are proposed for all Liqwid stables markets (DJED, iUSD, USDC, USDT, DAI) including v2 supply and borrow caps.

-Borrow caps should be set to 90% of the total supply for each stablecoin market.

-Supply cap should be disabled (similar to the ADA market disabled supply cap).

-Increase the baseRate for all stablecoin markets from 2% to 5% to reflect the current risk-free rate of the 3-Month US Treasury Bill.

Reasoning

-

An 80% borrow cap was implemented as part of the recent ADA market and risk parameter updates. This Liqwid v2 feature ensures lenders can access the pool’s liquidity during increased market utilizations. As utilizations in stablecoin markets are on average significantly higher and consistently in the 70% utilization range for most stablecoin markets a 90% borrow cap is proposed.

-

Similar to the ADA market, supply caps for stablecoin markets should be disabled by default. The supply cap in Liqwid for assets supported as collateral is used to set the debt ceiling for that asset.

*DJED is the only stablecoin that can be used as collateral in the protocol at this time due to its full redemption capability within the DJED protocol resulting in a hard floor for DJED of $0.985 as long as the protocol’s Collateral Ratio > 100% (1.5% redemption fee in the DJED protocol). -

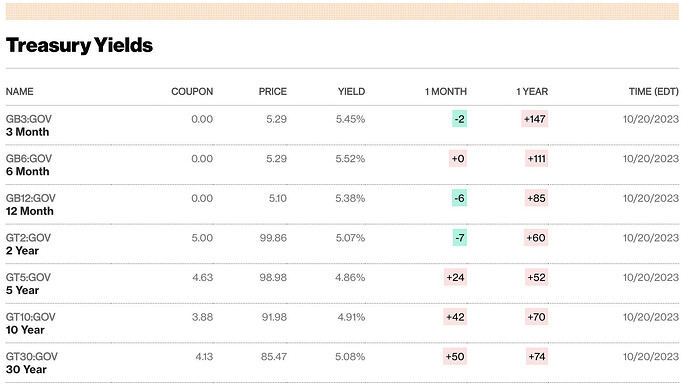

Interest rates for lending have traditionally been based on the risk-free rate, typically represented by the 3-Month US Treasury Bill, to which a premium is added to account for credit risk. The Risk-Free Rate is typically equivalent to the interest paid on a 3-month government Treasury Bill, considered one of the safest investments available to investors. Increasing the baseRate from 2% to 5% accurately represents current market conditions for borrowing dollars with the risk free rate of short term US Treasury yields above 5%.

Additional information on the interest rate model calculation

Resultant interest rate curve with updated baseRate (5%) parameter

Do you support these stablecoin market parameter updates?

- Yes

- No