Summary:

This proposal aims to remove all CNT from Market Participation Rewards (LQ market incentives to suppliers) and include ADA and stablecoin markets only.

Reasoning:

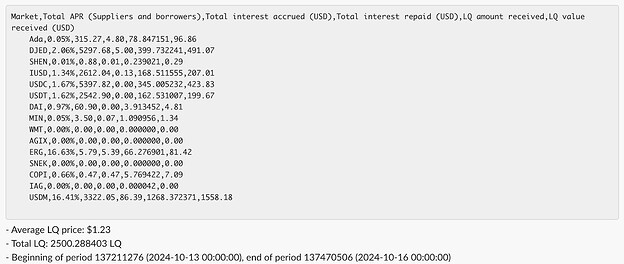

The majority of protocol revenue is generated from liquidity provided to the protocol by stablecoin and ADA suppliers. As such lenders in these markets should consistently receive the majority of LQ market incentives. At times minor changes in borrow volume in CNT markets causes outsized effects on the LQ market incentives APY for a market for the 3 day rewards epoch. This impact skews incentives too far in a CNT market when compared to ADA or a stablecoin market during the same rewards epoch.

Example shown in the ERG market with and without the skewed LQ market incentives APY

Risk Considerations"

There are no technological risks associated with this proposal, as it solely impacts the market participation rewards model.

Proposal Specifications:

If this proposal passes, LQ market participation rewards will remove all CNT markets and include ADA and stablecoin markets only.

Conclusion:

Liqwid Labs core team recommends implementing this proposal and removing all CNTs from the Market Participation Rewards calculations. Stablecoin and ADA suppliers provide the liquidity that generates the majority of protocol revenue and should consistently receive the majority of LQ market incentives.

Do you support this proposal to remove all CNTs from the Market Participation Rewards calculations?

- Yes, I support this proposal to remove all CNT markets from LQ Market Participation Rewards

- No, I do not support this proposal to remove all CNT markets from LQ Market Participation Rewards