Relevant links:

https://djed.xyz/

https://twitter.com/DjedStablecoin

https://twitter.com/COTInetwork

Summary

This is a proposal for creating a new liquidity market to support DJED stablecoin lending and borrowing on the Liqwid v1 protocol.

Project and Token Overview

DJED is a Cardano native overcollateralized stablecoin implemented by the Coti and IOG engineering teams. The protocol is unique for its 400-800% minimum collateral ratio for minting DJED. This makes for a strong collateral type for Liqwid users to lend and borrow with a relative degree of confidence in its collateral backing. The stablecoin launched on mainnet <1 week ago and already has a circulating supply of $1.9m.

Currently the DJED protocol has a collateral ratio of 616%

DJED Market Reasoning

Currently most DJED is being LP’d on Cardano DEX, most notably WingRiders where ~$1m in total is being LP’d across multiple pools.

The ability lend and earn interest passively on DJED stablecoin holdings does not yet exist in Cardano DeFi. This could drive minting demand for DJED as users will have an additional utility in pooled lending (notable differences being no impermanent loss, no need for a 2nd asset that opens LPs up to impermanent loss or depeg risk).

Historical borrow volume in Aave and Compound show strong trends overtime towards stablecoin borrow demand and we expect similar trends to emerge on Liqwid with the launch of the DJED market. Users supplying ADA will be able to open loans collateralized by their qADA tokens.

Security Considerations

Smart Contract Risk of DJED - DJED smart contracts were built by IOG and audited by Tweag. The full audit report can be found here: tweag-audit-reports/Djed-2023-01.pdf at main · tweag/tweag-audit-reports · GitHub.

While the smart contracts are built by IOG and audited by Tweag the protocol has been live on mainnet for just under one week.

Stablecoin Risk - The stability of DJED is based on a required protocol collateral ratio of 400-800%. The protocol remains extremely overcollateralized by ADA holders minting the SHEN reserve token. The following chart from Coti shows when DJED and SHEN are minted and burned based on the protocol’s collateral ratio:

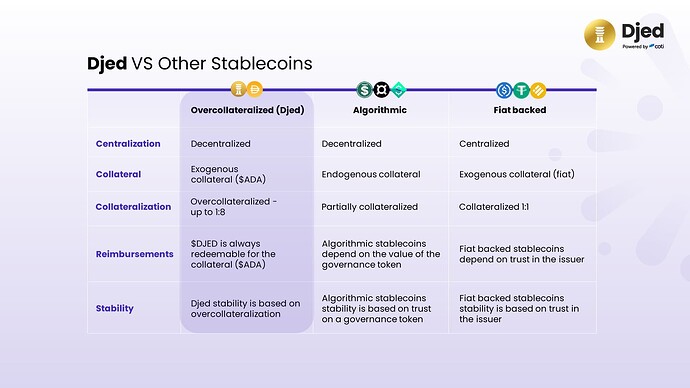

Unlike centralized fiat stablecoins DJED’s issuance and redemption model is executed entirely on-chain backed by ADA collateral. The following chart from Coti compares DJED overcollateralized model to fiat and algorithmic stablecoin models:

Specifications

The Liqwid Labs developers have already completed the technical work to list the DJED market including: testing the proposed stablecoin interest rate model, completing the off-chain updates to support multiple collateral asset loans, configuring the DJED oracle price feed, confirming DJED’s FixedToken and other token properties relevant for listing.

Suggested DJED Market Parameters

The proposed DJED interest rate algorithm parameters and resultant interest rate curve for suppliers and borrowers are as follows:

The proposed DJED risk parameters are as follows:

*collateral factor is the maxLTV.

*Any updates to this proposal will be labeled as Amendments.

Do you support this proposal to add support for DJED lending and borrowing on Liqwid v1?

- Yes

- No