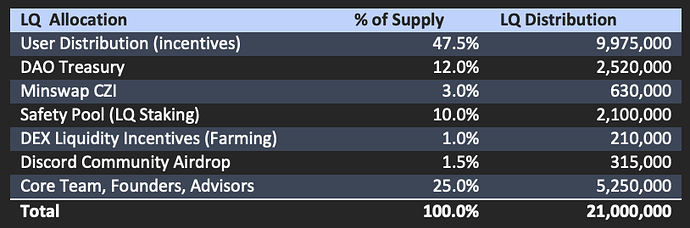

The Liqwid v1 protocol is approaching its mainnet launch alongside the Liqwid DAO’s Agora instance. In preparation for the start of on-chain community governance, LQ staking and incentives we are now publishing the final LQ tokenomics which accounts for all previous temperature checks, proposals and community discussion on the governance forum. This updated version aligns the common threads expressed in the proposal 1 and 2 community discussion. The Liqwid community has always led with transparency, fairness and an openness to adopting innovative models that better aligned the Liqwid protocol with its users and LQ holders. With 75% of LQ supply allocated for community (starting with the Discord Community Airdrop in January of last year) we feel our team’s vision with respect to governance models, emission schedules and community empowerment is expressed in an equitable token allocation and distribution schedule.

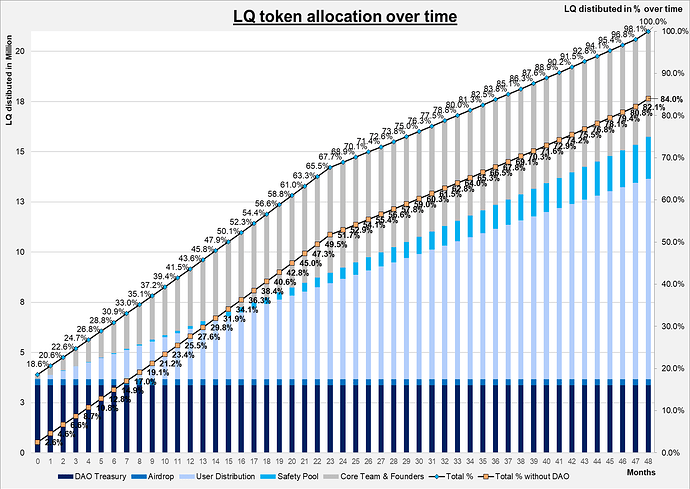

User Distribution (lending/borrowing incentives): Incentives to lenders and borrowers will be distributed over 48 months and the allocation key will be based on the amount of interest paid each day by the borrowers in each market. It will be split 50-50 between the suppliers and the borrowers, and the total LQ amount per market will be also incentivized through a multiplier (i.e. the rewards generated for supplying or borrowing ADA could receive per $1 more LQ than those generated for Token Z). These will be updated through governance votes. The calculation of these rewards will be done since mainnet launch, but the distribution of rewards will come after (developers will either build a Liqwid specific rewards distribution mechanism or utilize an existing one from another Cardano project).DAO treasury: These tokens are controlled by the DAO with the primary purpose of funding community driven projects and initiatives.

*In the event more complex transactions are required beyond a simple transfer a multi-signature wallet owned by the LiqwidDAO Association will be utilized.

Minswap Collective Zap-in (CZI): 3% of the LQ supply will be sold via the Minswap CZI to allow anyone to 1. bootstrap the protocol owned liquidity (POL), 2. allow market participants to acquire LQ tokens early on and 3. to increase the Liqwid ecosystem’s collective decentralization through a larger base of LQ token holders. Learn more about how the CZI mechanism design and how it helps boost a protocol’s owned liquidity in this Minswap article.

*1.5% of LQ token supply was allocated to the Discord Community Airdrop which was completed around this same time last year (January 2022). After receiving feedback from multiple community members who were unable to participate and acknowledging how much our community has grown since then we have elected to make double this amount available for the CZI.

This transaction will secure a meaningful amount of protocol owned liquidity (POL) for LiqwidDAO in the near term and through community proposals also fund innovative products and tools built on top of Liqwid.

More details about the CZI process will be announced shortly.

Safety Pool (LQ Staking): LQ holders can deposit their LQ in the Safety pool on Liqwid, which acts as an insurance layer for protocol users in the case of a Shortfall Event. The staked LQ will be used as a loss compensation tool in case of a Shortfall Event within the money markets that belong to the Liqwid protocol. A Shortfall Event occurs when there is a deficit.

*As counterparty for this responsibility, LQ staked in the Safety Pool allow their holders to: 1. vote with their LQ on governance proposals (1 LQ = 1 vote), 2. earn 5% per year (APY) on their LQ (staking reward), and 3. receive a “dividend” as counterparty for the slashing risk, which is financed by the interests paid by borrowers.

The “dividend” feature will be subject to an on-chain vote for activation after mainnet and the staking feature will be activated shortly after mainnet once the governance portal UI is launched.

DEX incentive pool: These tokens are allocated to incentivize liquidity for the LQ/ADA trading pair.

Airdrop: Implemented in January 2022, where 315,00 tokens were distributed to the Discord users, and 50k were distributed to the Core Team and Advisors.

Core Team and Founders: The tokens will be distributed over a linear 2 year vesting schedule which goes into affect starting at Liqwid v1 mainnet launch.

*Liqwid investor disclosure: Liqwid core team completed a seed fundraising round in Q1 2022 to finance development costs and accelerate the delivery of the v1 smart contracts. The vesting period for the private investors is 2 years linear with a 4-month cliff starting at mainnet launch.