preface: we are unfortunately non fluent english speaking and haven’t used translation software or IA to redact this temp check. We bet on your indulgence if some sentence should have been worded differently ![]() ; and we hope the main idea will get through the barrier of language

; and we hope the main idea will get through the barrier of language ![]()

Fellow Aquafarmers and beautiful people,

We are glad to introduce the nibiru proposal temp check:

![]() LQ stake tiers requiered to unlock full potential of

LQ stake tiers requiered to unlock full potential of ![]() LQ rewards for provided assets.

LQ rewards for provided assets.

Part I: why?

We observed that:

Most of crypto exchanges/platforms/protocols ask their users to hold a minimum of their native asset to unlock the best rates for rewards services, or access full potential of a platform.

For instance, you will need:

-tappy nfts ![]() to unlock all the power of taptools;

to unlock all the power of taptools;

-a certain amount of BNB to earn maximised rewards on Binance and discounted fees;

-a certain amount of CRO to get the best rates on crypto.com; or the best cashback rewards using the debit card.

-etc etc, examples are endless. Bringing this kind of utility to a token is not new at all and almost every protocol do it, we hope you see the point here ![]()

![]() concerning Liqwid

concerning Liqwid ![]()

As of today anyone can supply 100k $ of stablecoin (or any asset) to Liqwid and enjoy maximised rewards paid in LQ (full potential) without having to hold a single LQ.

While this seems fair, as we are big supporters of the protocol and its governance token ![]() LQ, we would love to discuss the possibility of introducing the same kind of concept highlight above; which unlock the best rates to assets providers only if they stake a minimum amount of LQ in prorata of their assets value. If the LQ tier requirement is not met, there will be a penalty and the user lose some LQ rewards which will be re-distributed to LQ stakers and - why not- protocol treasury.

LQ, we would love to discuss the possibility of introducing the same kind of concept highlight above; which unlock the best rates to assets providers only if they stake a minimum amount of LQ in prorata of their assets value. If the LQ tier requirement is not met, there will be a penalty and the user lose some LQ rewards which will be re-distributed to LQ stakers and - why not- protocol treasury.

Indeed, we believe there should be a reasonnable amount of LQ to be staked by one user to unlock the full potential of Liqwid protocol rewards. We think it should be priced in % of provided asset by user with between 2 and 5 tiers maximum (to be discussed).

Part II: how?

We think the full potential unlock should not exceed 5% of the value of the assets provided by one user but this is to be discussed together perhaps some of you may say 10%. We don’t want to discriminate against shrimp wallets.

For instance, in the case we setup a 5 tiers LQ proof of stake program, what the rewards unlock could look like ?

We can imagine some reasonnable rates like:

tier 0: 0% lq staked = 50% penalty ![]()

tier 1: 1% lq staked= 40% penalty

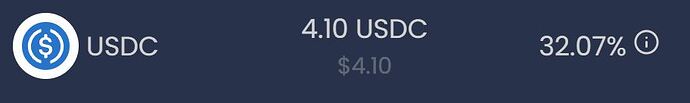

tier 2: 2% lq staked = 30% penalty ![]()

tier 3: 3% lq staked = 20% penalty

tier 4: 4% lq staked= 10% penalty ![]()

tier 5: 5% lq staked or more =full potential unlocked ![]()

Looking at these rates you see that it is much better for your rewards if you stake a minimum of ![]() LQ.

LQ.

Part III: a few examples

Lets see a few examples with our old crypto friends Alice and Bob:

![]() Alice is providing 100k of USDC to Liqwid and earns approximately as of today’s rates 20% (20k$) of LQ per year. But Alice stake 0 LQ because she has decided to milk the protocol by selling her LQ rewards as soon as received for more Ada and USDC (which is a strategy like another, we do not judge her).

Alice is providing 100k of USDC to Liqwid and earns approximately as of today’s rates 20% (20k$) of LQ per year. But Alice stake 0 LQ because she has decided to milk the protocol by selling her LQ rewards as soon as received for more Ada and USDC (which is a strategy like another, we do not judge her).

If the proposal pass, what does this means for Alice? She is providing assets but got no LQ staked ![]() Well, her LQ stake is worth 0% of all the assets she provided to Liqwid : she qualifies for tier 0 and she will get half of the rewards (50%) she should get if she had some more LQ staked. the other half is redistributed to LQ stakers and protocol treasury.

Well, her LQ stake is worth 0% of all the assets she provided to Liqwid : she qualifies for tier 0 and she will get half of the rewards (50%) she should get if she had some more LQ staked. the other half is redistributed to LQ stakers and protocol treasury.

![]() Alice will earn (in one year) 10.000$ worth of LQ instead of 20.000$

Alice will earn (in one year) 10.000$ worth of LQ instead of 20.000$ ![]() . the missing LQ (worth 10.000$) will be re-distributed to LQ stakers and -why not- protocol treasury.

. the missing LQ (worth 10.000$) will be re-distributed to LQ stakers and -why not- protocol treasury. ![]()

Now let’s see Bob. Bob is providing a basket of native assets to Liqwid, for a total worth 10.000$. Moreover, he stakes some LQ token worth today 500 $. That is 5% of the value of the assets Bob provided. Bob qualifies for tier 5 and is enjoying the full potential of the protocol as long as his LQ stake is worth more than 5% of the assets he provided. Bob is smart (but please note we love Alice too).

Conclusion:

From our point of view, this proposal bring more value to the ![]() LQ asset in 2 ways:

LQ asset in 2 ways:

-from one side it contributes in increasing the demand for the ![]() LQ asset (by lowering the sell force

LQ asset (by lowering the sell force ![]() );

);

-and from the other side it creates a new stream of revenues to the LQ stakers and reinforce the protocol treasury.

This is all. We are impatient to read your feelings about this, please share your feedback! do you feel the idea is pleasant? Does it need some adjustments? Or is it evil and stupid, and shall we forget it and never speak about such an idea ever again?

Also which of the ADA or USD value should be taken into account when computing tier?

With regards,

nibiru ![]()