Proposal description

This proposal aims to implement an LQ token buyback by redirecting the current protocol revenue, which currently allocates 50% to LQ stakers and 50% to the DAO treasury, to be used exclusively for LQ token buybacks. This would effectively end the so-called “programmatic distributions” paid out to LQ stakers each month.

Suppliers will continue earning 80% of all interest across all markets. These proposed changes will not affect the 80/20 net interest margin ratio but only redirect how the 20%—currently split between LQ stakers and the DAO—will be allocated in the future.

The LQ buybacks will follow a 30-day Dollar-Cost Averaging (DCA) approach, utilizing the total interest repaid, loan origination fees, and voting rewards generated in the previous month. All LP fees generated from the Minswap POL position will also be applied to buybacks. The buybacks will begin in October, using revenue from September, and will continue until June 30, 2025. After that, a new vote will determine how this portion of the protocol’s revenue will be allocated moving forward.

The purchased LQ will be added as collateral to the Core Team Financing Loan, improving the position’s health factor until the loan is fully repaid.

Proposal reasoning

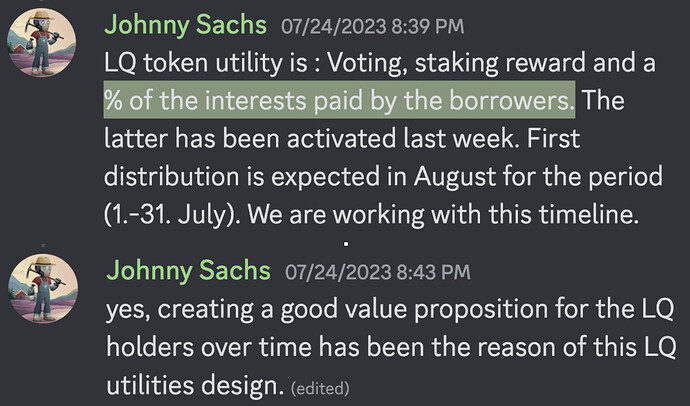

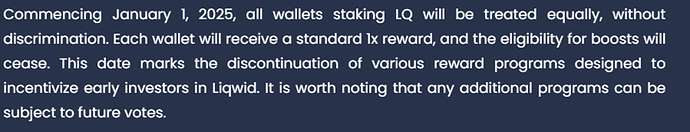

The current method of distributing protocol revenue to long-term, DAO-aligned LQ holders uses historical stakes to reward LQ stakers with boosted ADA yields. However, with these historical stakes being phased out in January 2025, a more strategic approach aligned with the DAO’s vision for growing the Liqwid ecosystem should be adopted. Without the current multiplier rewarding long-term staking, the protocol would treat short-term and long-term LQ stakers equally.

LQ buybacks present a simpler, future-proof solution for rewarding long-term, DAO-aligned LQ stakers, offering a significantly less complex rewards model.

This proposal does not modify the current staking rewards, as established in last year’s Proposal 48. As a reminder, all LQ stakers are earning a 5% annual base yield, applied equally to every stake and user. The Aquafarmer boost remains the only multiplier that allows users to earn a higher LQ staking APY beyond the 5% base yield.

To summarize, the LQ buyback program enables the DAO to:

A. Future-proof the LQ rewards model in preparation for the end of historical stakes at the beginning of next year.

B. Implement a more strategic approach for rewarding long-term, DAO-aligned LQ holders.

C. Strengthen the health factor of the Core Team Financing Loan.

Note: In addition to these benefits, the LQ buyback approach offers a more tax-efficient solution for most LQ holders compared to programmatic distributions. Buybacks are typically taxed only on capital gains from the actual sale of LQ tokens, whereas programmatic distributions may be subject to taxes ranging from 15% to 20%, depending on the country of residence.

This is not financial, tax, or legal advice. You should consult a tax professional in your country or region for confirmation.

Risk considerations

There are no significant risks associated with this proposal, as it only affects the distribution of the net interest margin.

Specifications

If this proposal passes, LQ buybacks will begin immediately after the voting phase concludes. Upon adoption, the program will start in October 2024, using revenue generated in September 2024, and will conclude on June 30, 2025.

Conclusion

The Core Team recommends implementing this proposal and initiating the LQ token buyback program.

Do you support this proposal?

- Yes, I support this proposal.

- No, I do not support this proposal.