Proposal Overview

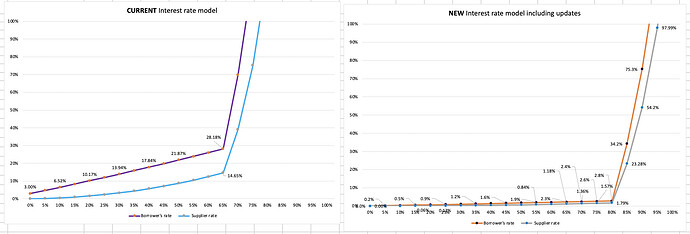

This proposal seeks to implement 4 updates to CNT markets, wanBTC, wanETH interest rate parameters:

- Decrease the utilMultiplier to 3.5% for each market.

- Decrease the baseRate to 0% for each market.

- Update borrow cap to 90% for each market (excluding LQ).

- Update the kinkPoint to 80%.

Markets Update Reasoning

-

To stimulate utilization in CNT, wanBTC and wanETH markets a flat interest rate curve that enables more capital to be borrowed at a lower rate and a more gradual rate of change must be implemented. To achieve this flatter curve a significant decrease to these market’s utilMultiplier is required.

-

Lowering the baseRate to 0% will help stimulate borrowing activity in these markets by offering ultra competitive 0% interest rates to borrowers in low utilized markets. Yield arbitrage strategies that capture the spread of borrow APR and staking yield in these protocols can now be efficiently executed.

-

Updating the borrow caps to 90% for these markets (excluding LQ) allows the majority of the liquidity pool to be borrowed and earning lenders the highest yield possible on their assets.

-

Increasing the kinkPoint to 80% enables the maximum amount to be borrowed at the lowest rates. Optimizing for capital efficient borrowing allows the protocol to generate maximum revenue as more capital can be actively borrowed without a steep increase in interest rates that occurs in slope 2 post-kinkPoint.

Current and newly proposed interest rate models:

Risk Considerations

A major risk consideration with this update is liquidity risk to lenders as utilization in these markets grows. This risk is mitigated to an extent by supply and borrow caps applied to these markets. Supply caps determine how much of each asset may be deposited and used as collateral based on the assets onchain liquidity. Borrow caps determine the maximum percentage of the market allowed to be borrowed from the protocol.

Specifications

Liqwid Labs developers have completed the necessary testing and technical requirements needed to implement the proposed interest rate parameter updates to the markets.

Conclusion

Liqwid core team supports these updates to the CNT, wanBTC and wanETH market’s interest rate curves to boost borrow demand.

Do you support this proposal to update these market’s interest rate curve parameters?

- Yes, I support this proposal.

- No, I do not support this proposal.