Summary

This is a proposal for creating a new liquidity market to support the ERG token for lending and borrowing on the Liqwid protocol. ERG will be enabled as an isolated collateral in the ADA market only.

Relevant Links

https://ergoplatform.org/en/community/

https://twitter.com/RosenBridge_erg

Project and Token Summary

Ergo has implemented multiple eUTXO innovations including oracle pools, and the initial reserve token based stablecoin implementation (SigmaUSD on Ergo, later DJED). Cardano and Ergo developer communities have long shared a symbiotic relationship with the focus on pioneering innovative eUTXO protocols.

ERG will soon be supported through the Rosen bridge (an open-source protocol for cross-chain asset transfers). Details on how Rosen bridge’s guard and watcher security architecture operates can be found here: https://rosen.tech/

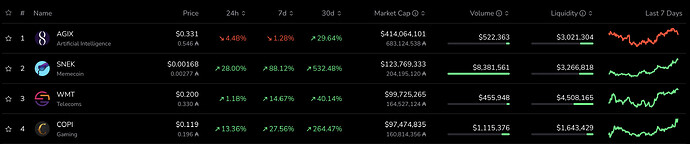

When the Rosen bridge goes live ERG will be a top 5 asset on Cardano by MarketCap (AGIX, SNEK, ERG, WMT, COPI) with ~73.7% of total supply in circulation.

Source: https://www.coingecko.com/en/coins/ergo#markets

Source: https://www.taptools.io/

Risk Considerations (economic): Rosen bridge is a newly launched bridge and will facilitate all of the ERG-ADA liquidity across Cardano DEXs. The majority of ERG liquidity and volume is on centralized exchanges (KuCoin and Gate have 10/10 trust scores on CoinGecko). The risk here is liquidators must rely on these venues to source ERG liquidity and in a timely fashion during volatile market conditions.

:

Risk Considerations (technical): The bridge implements a unique guard and watcher security system with validation by multiple node operators. Multiple prominent Cardano SPOs and Ergo Mining Pools are operating as the initial set of guards and watchers. The is also said to have been audited by Ergo founder Kushti.

Suggested ERG Market Parameters

The proposed ERG liquidity market parameters and resultant interest rate curves for lenders and borrowers are equivalent to the ADA market, starting with a 3% BaseRate at 0% utilization.

- RateBase: 3.00%

- RateNormal: 40.00%

- RateJump: 600.00%

- Kink: 65.00%

Income Factor: 80% of the interests paid by the borrowers are payed out to the suppliers (equal to the ADA and stablecoin liquidity pools). The remaining 20% is net margin:

- Reserve Factor: 0%

- DAO Factor: 10.00%

- LQ stakers: 10.00%

Proposed ERG Risk Parameters:

ERG supply cap will be set to $2,055,000. ERG borrow cap will be set to 50% of the total ERG supplied.

- Collateral factor (maxLTV): 51.4%

- Liquidation threshold: 51.5%

- Liquidation penalty: 15%

*ERG will be supported as an isolated collateral in the ADA market.

Specifications

Following this temperature check, the core team will configure the ERG oracle price feed and deploy it alongside the suggested ERG market and risk parameters for testing on Preview. Core team also set to complete sufficent independent testing for the Rosen bridge upon mainnet launch.

Conclusion

The core team recommends the adoption of this proposal and to add ERG as a token for lending and borrowing and as isolated collateral in the ADA market on Liqwid with the suggested market and risk parameters outlined above. Ergo developer community has created multiple innovative eUTXO protocol design and has always had strong ties to Cardano. Rosen implements a major paradigm shift in enabling interoperability between these networks for the first time. There are economic and security risks to consider.

Do you support this proposal to add an ERG liquidity pool on Liqwid and support ERG as isolated collateral in the ADA market on Liqwid?

- Yes

- No