Summary:

This is a proposal for creating a new market to support USDA stablecoin token for lending and borrowing on the Liqwid protocol.

Project and Token Overview:

USDA is a fiat-backed stablecoin issued by the Anzens team and built by Emurgo teams: https://www.anzens.com/.

Similar to USDM (Moneta) the USDA stablecoin is backed by USD reserves held in a custodial bank account. As such the Liqwid Labs core team proposes launching the USDA market with the exact same parameters as USDM.

Fiat-Backed Stability: Every USDA token is backed 1:1 by USD in a regulated custodian’s bank, ensuring its stability and reliability in the volatile world of cryptocurrencies.

Cardano Integration: As a Cardano native asset, USDA benefits from the security, efficiency, and interoperability of the Cardano blockchain.

USDA Market Reasoning:

Stablecoins are needed for bootstrapping liquidity in Liqwid and Cardano DeFi. USDA has a strong tech team and operations team backing it therefore we propose to add the USDA token as eligible market on Liqwid for supplying and borrowing (incl. being used as collateral).

Risk Considerations:

USDA though not yet launched has been vetted by the Liqwid core team including multiple due diligence discussions with the Emurgo and Anzens teams. We are confident that the technology and team is solid, and that their operating model ensures that Anzens (USDA) tokens are backed by sufficient USD reserves in the bank account of a regulated custodian banking partner.

As liquidity fluctuates, USDA remains backed 1:1 by USD reserves. As such we propose to hardcode the value of USDA at $1 in Liqwid without using any external oracles. This is the same method Liqwid currently uses to price USDM.

Suggested USDA Market Parameters:

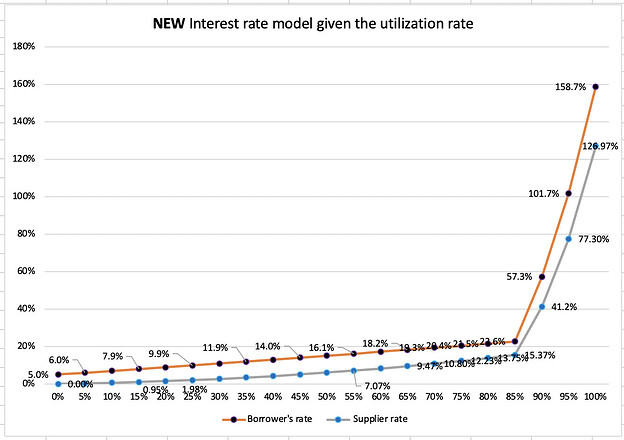

baseRate: 5%

utilMultiplier: 33%

kinkPoint: 90%

Utilmultiplierjump: 100,000%

Supply Cap: $10M

Borrow Cap: Disabled

Proposed USDA Income Factor:

20.00% (80% of the interests paid by the borrowers are given to USDA suppliers). The remaining income is split as following:

- Reserve Factor: 0%

- DAO Factor: 10.00%

- LQ stakers: 10.00%

Proposed USDA Risk Parameters:

- Collateral factor ( maxLTV): 79.9%

- Liquidation threshold: 80%

- Liquidation discount: 10%

*USDA will be accepted as collateral in all markets.

Proposal Specification:

The Liqwid Labs developers have already completed the technical requirements to list any new Cardano native token. Following this temperature check, the team will work on USDA preparation work including: testing the proposed interest rate model and configuring the oracle price feed (will be hardcoded at $1 same as the current setting for the USDM market oracle price feed).

Conclusion:

Liqwid Labs Core Team recommends the adoption of this proposal and to add USDA as an asset for lending and borrowing on Liqwid with the proposed market parameters.

- Yes, I support this proposal to add support for a $USDA market on Liqwid

- No, I do not support this proposal to add support for a $USDA market on Liqwid