Who are IAGON?

Iagon is a leading technology company based in Norway that is developing a decentralised storage & compute protocol. Incorporating advanced machine learning algorithms in conjunction with blockchain technology to provide secure, scalable, compliant and cost-effective data storage and processing which can be customised to comply with fast-moving compliance regulations.

Proposal As a community we would like to propose allowing $IAG as an available asset on Liqwid, this will result in an extremely large and positive impact for the Liqwid protocol and Liqwid users based upon the following reasons:

Increased Protocol Audience Exposure - Iagon has an extremely strong & large international community around them, with over 14.1k followers on Twitter & over 8,500 token holders, $IAG is currently situated in the top 10 projects in Cardano by Market Cap, this community is unique as it consists of a joint audience of both Cardano & Ethereum users, which were recently migrated to Cardano when IAGON decided to utilise Cardano as it’s blockchain of choice.

-

Liqwid Protocol will benefit from exposure to this unique extended audience.

-

Liqwid Protocol will also benefit from increased volume.

-

Liqwid Users will also have increased borrowing & lending opportunities as a result of the above.

-

Liqwid Statistics & Marketing will benefit from all of the above.

The addition of $IAG as an asset class will allow for more Cardano community members to enhance a network of storage and in future compute. The ability to borrow $IAG and run nodes while earning rewards which can be of additional benefit to the protocol of both Liqwid and IAG sustainability together as one.

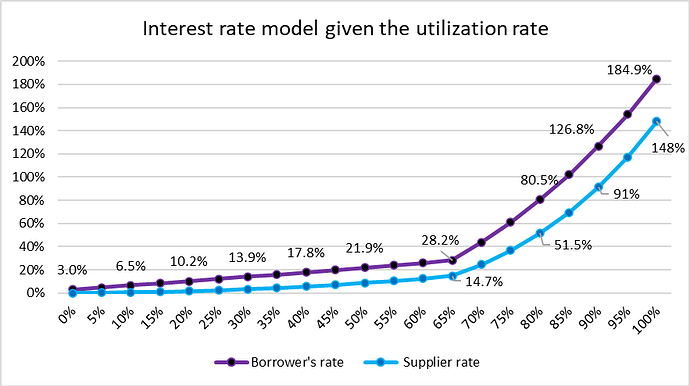

Remaining cautious and to ensure the protocol does not take on any bad debt $IAG’s proposed risk parameter’s match those proposed for WMT’s use as shown below(this can of course changed with a future proposal):

Do you support an $IAG market on liqwid?

- Yes

- No

Resources:

Iagon Blog - https://blog.iagon.com

Iagon Roadmap - Iagon Roadmap 2023-2025

Iagon European Patent - [EPO - European publication server ](https://European Patent)