Summary

This is a proposal for creating a new liquidity market to support Cornucopias (COPI token) for lending and borrowing on the Liqwid protocol.

Project and Token Overview

The Cornucopias Game has entered its testing phase with a team consistently delivering over time.

The game environment is a sky-based open world that is set in the atmosphere above the Earth’s surface. It becomes clear that Earth’s ability to support the human race is quickly dwindling. Twelve scientists are tasked to come up with a solution to save the population.

After discovering a new technology that’s able to create anti-gravity the scientists developed the idea of the sky domes. A plan was hatched to create 12 unique zones, each one containing 3 domes. Each zone would have a different theme inspired by the different cultures and periods of time we knew on Earth.

The new world of Cornucopias is in its infancy and the citizens are just starting to figure out their role in this new world. The economy is just getting up and running with many questions remaining. Join in the experiment and discover where you fit into this new world.

COPI token is a Cardano native token and is traded across all CEX and DEX platform.

Protocol information: Play Your Way | About The Game | Cornucopias

Token information: https://www.coingecko.com/en/coins/cornucopias

Market Reasoning

The COPI token is listed on many CEX/DEX, and numerous external parties engage in arbitrage between these platforms. This suggests that in the event COPI tokens are sold on a DEX as part of a liquidation process following a defaulting loan where COPI serves as collateral, we are confident that liquidators would encounter sufficient liquidity and experience low slippage due to these arbitrageurs. Therefore, we propose to add the COPI token as eligible collateral on Liqwid.

Risk Considerations

The project has not yet fully deployed its game but it has many promises (Road Map | COPIWiki). It is still in its “infancy” phase, which led to a conservative approach regarding its maximum authorized collateral factor.

Suggested Market Parameters

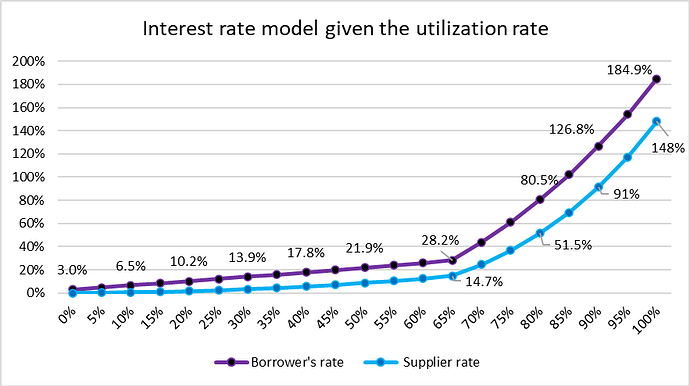

The proposed COPI interest rate algorithm parameters are:

- BaseRate 3.00%

- utilMultiplier 40.00%

- utilmultiplierjump 600.00%

- Kink rate 65.00%

These are the same parameters as AGIX, WMT or MIN.

Income Factor: 20.00% (80% of the interests paid by the borrowers are given to the suppliers).

The remaining part is split as following:

- Reserve Factor: 0.00%

- DAO Factor: 10.00%

- LQ stakers: 10.00%

The proposed COPI token risk parameters are:

- Collateral factor ( maxLTV): 39.95%

- Liquidation threshold: 40%

- Liquidation discount: 15%

The supply cap for COPI will be set to $1.00M and a corresponding number of tokens will be calculated at the Liqwid’s listing date to match this value. COPI token borrow cap will be set to 25% of the total COPI supplied.

Specifications

Liqwid Labs developers have already fulfilled the technical requirements for listing any tokens. Following this assessment, the team will proceed with the preparation work for listing COPI, which includes: 1) testing the proposed interest rate model, 2) finalizing off-chain updates to support loans with multiple collateral assets, and 3) configuring the oracle price feed.

Conclusion

The Core Team recommends the adoption of this proposal and to add COPI as a token for lending and borrowing on Liqwid with the proposed market parameters.

- Yes, I support the addition of $COPI as a new market on Liqwid.

- No, I do not support the addition of $COPI as a new market on Liqwid.