These are some good points. I agree with these comments.

What information on Agora is needed to make a decision here? Agora is a governance module that enables users to stake LQ in it to determine voting power, when the developers at MLabs, Liqwid and ADAO have completed the modules v1 functionality it will be open sourced with supporting documentation. Happy to answer any questions you have before then or ask one of the engineers working on it if I can’t answer your questions.

“Why make us choose” makes little sense to me, users will always have multiple options to put their LQ to work that’s the entire point of DeFi launching at scale (e.g. users can already yf w/ LQ in several DEXs). Including an allocation to ensure liquidity on the most advanced DEX is sufficient at launch is a prudent step imho.

Liqwid and SS as partnership is strategic, if Liqwid did not see it as mutually beneficial then they would not be partners. Liqwid would be providing LP incentives to their partner because they are the most advanced DEX on Cardano. Yes they are also, the only one; DC has said himself:

He is definitely not ruling out the idea of doing the same with another DEX when they reach a certain point.

Since I see the need for liquidity and understand the possibility that new dexs that are launching may not have the depth needed by Liqwid, I voted for this.

But, I think that if Liqwid is going to start incentivizing liquidity and farming on dexs I would rather have seen a separate proposal.

In that proposal we could outline the basic characteristics of dexs we want to yield farm on and then a process by which to choose them. This way we have a baseline of minimum qualification for an allocation.

Once that was done, then a separate proposal to allocate to SundaeSwap. Currently 840,000 LQ at current market price, 100 ADA, is 84,000,000 ADA. That is a significant allocation and really should be addressed separately. Topics like; what is the purpose, goals, and desired outcome could be addressed.

As the current proposal stands we are asked to vote on two separate questions:

- Adjust the tokenomics

- Allocate to Sundae Swap

Unless you agree or disagree with both questions you are in a bit of a conundrum.

I voted yes on this because I seen the need and I think SundaeSwap would be a good place to make the allocation.

But, we also need to make sure we are only voting on a single question per proposal in the future. Otherwise processes derived from these decisions could simply be a mish mash of unrelated outcomes that could weaken the future DAO.

Rewarding the stakers, the “safety” of the protocol, is a good thing. I voted for.

I completely agree with this. I would suggest we take a snapshot of TVL in all Cardano DeFi platforms about 2 weeks before LQ mainnet launch and divide the 4% allocation between any of them above a specified threshold, such as 5% total Cardano TVL.

As a current LQ/ADA LP provider on SundaeSwap I think we must have the rewards to incentivize participation, I’d be completely rekt by Impermanent Loss if they didn’t have the additional Yield Farming available. It also makes sense to categorize the Token Allocation to show distribution across contribution options! I would expect for the remaining 47.5% we would break it up into specific categories as they are identified.

this commentary is a must read. I also would like to know more details on yield and what the proposal aims to do over time

Liqwid proposes to allocate 17% for Agora stakers when V1 launches. Liqwid proposes to allocate 4% to Sundae when V1 launches. Both reward mechanisms will be active at the same time. Users have a choice, what information do they have to make a choice on one or the other (or both)?

Hi all. I’d love to vote but it doesn’t seem like I have the option. Is there anything I need to do apart from joining in order to vote?

I believe voting ended yesterday. You should be able to participate in the next proposal tho

cheers bro, That makes sense

I missed the early participation for the protocol. Am i still eligble for next drop or distribution? Thank you

same I’m definitely interested. I was in the discord airdrop

I agree with you on this and I think we must emphasise more on the necessity to maintain price stability for long term growth of the protocol.

I wanted to gather the community sentiment for a change in the LQ token distribution and consider an additional utility.

As it stand, while we can all appreciate the efforts made by the team to give utility and a multi yield strategy for the token at launch, we’ve seen too many projects facing almost inevitably a significant sell pressure as more LQ rewards gets emitted/rewarded.

I also understand the need to provide deep liquidity for LQ/ADA pairs and therefore to provide LQ incentives where and when required.

While the multi yield strategy is great if you are long on LQ and understand the vision and potential of the protocol, we should also anticipate that many users could see it differently and see LQ as a farming token to realise their gains immediately and move on. (more so as we incentivise liquidity on other DEXs.)

Like @JWolfish, I also see tremendous value to re-visit what the recent « Defi 2.0 » projects taught us with initiatives like xSushi, veCurve, and Protocol owned Liquidity (PoL) mechanisms, for the Liqwid tokenomic to prevent downward pressure on LQ.

The LQ up only strategy

Please @DC1 correct me if I am wrong, but I believe LQ’s built in liquidation platform gains access to cheaper native assets by liquidating undercollateralized loans.

The DAO could vote for the native assets to hold long term within a treasury pool and rather than rewarding protocol depositors, borrowers and stakers with LQ and qtoken staking interest denominated in Ada, the protocol would reward users in xLQ which in essence would be the representation of the user’s ownership of that treasury pool and by definition a yield bearing asset that accrues protocol fees as you hold it.

While I imagine the pool starting with only Ada and LQ, moving forward, xLQ would potentially be even more attractive if the qtoken interests are denominated in the previously selected native assets, making xLQ a yield bearing asset with a value attached to a basket of assets, similar to a financial index token.

Bond — IN : $LQ — OUT : $xLQ.

Unbond — IN : $xLQ — OUT : $qADA + $native token B + $native token C + $LQ (and any other native token voted by the DAO).

xLQ would be an ideal token for users to hold, Mint, Accumulate and use as collateral on other Cardano Defi dApps due to strong ability to hold its value during intense market volatility. Imagine xLQ accepted as collateral for borrowing stablecoin

This approach would also fit nicely with the Agora Safety module requirement, as users can decide to stake a portion of their xLQ in Agora to boost their overall xLQ exposure hence de-risking Agora depositors over time in the event of shortfall.

This would reduce drastically the inevitable risk of sell pressure on LQ post launch and allow better management of LQ incentives while adding upward pressure on LQ as the non desired liquidated native assets would be sold to buyback LQ on the open market and add more LQ to the pool. Scarcity through LQ bonding and staking xLQ will likely create upward pressure and LQ price action could end up being up only…

When LQ holders want to realise their gains they would unbound xLQ receive their native assets earned including LQ and most likely sell those and re-bond LQ in order to increase their xLQ position and generate further passive income. And if technically possible I would even go as far as distributing liquidity incentive in the form or xLQ on Liqwid platform as well as on other DEXs.

This approach is currently experimented on Terra blockchain with one of their liquidation protocol for the above reasons described.

Thoughts?

Protocol owned liquidity means balance sheet, the DAO Treasury already has it and it will grow as borrow interest is repaid across markets. That begins on day 1 of launch. congrats POL achieved.

Also your understanding of the liquidation mechanism is very incorrect.

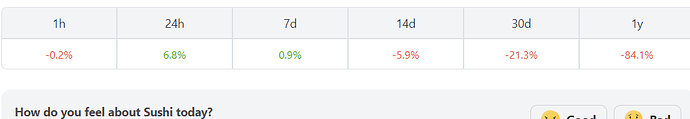

Your xLQ model makes little sense to me, anyone can unbond take their LQ and dump. If you are actually fooled into thinking ve Tokens work in making price go up only please explain to me why Sushi which has xSushi is down 84% in the last year?

Protocol owned liquidity means balance sheet, the DAO Treasury already has this via its LQ allocation and will grow each epoch from borrow interest repayments. Congrats we have achieved POL even pre-launch.

A bonding program presents strong sell incentives due to the difference in market price and the cost to accrue LQ via bonding. We have already discussed this concept in depth in the governance discussion channel on Discord. I hard disagree with any notion bonding program does not also come with significant sell pressure, that’s a very false narrative to try and push here.

As DC pointed out, its been employed by xSushi and its still down 84% this year. So, to me it doesn’t seem like it really holds the notion of

Most of defi is down 80% that isn’t a smart metric.

My primary concern was that the DAO Treasury would be denominated in LQ or ADA only, but if fees are denominated in all the various other whitelisted underlying assets accepted by the protocol as mentioned by @JakeMN on discord, then that is indeed a good treasury setup in my views as it should reduce volatility of the treasury fund.

For the xLQ model I mentioned, I come from the angle that no matter what we, do users will need to exit their position and sell their farmed token to use it as they wish at some point. Having said that, by rewarding them with a basket of assets as oppose to LQ only, some users will unbound and sell LQ, while others will unbound and sell their other native assets earned on the platform hence reducing LQ sell pressure.

From a user perspective who wants to accumulate a certain type of native assets, it makes little sense to unbound and dump LQ given you need LQ to access xLQ and farm your valuable native assets.

I was not implying that Liqwid should consider veToken. Maybe I should have said a qLQ that accrues interest in the multiple tokens that will form the Treasury.

Then by having a basket of valuable native assets as rewards, all accruing within qLQ derivative, I believe it creates an even more robust reason to hold. qLQ would be also a great asset to hold from a tax perspective in many jurisdictions.

To your last point I think we can agree that performances of a project as a whole is not only down to one or two features and Sushi have had many other problems to justify their poor performances.